Understanding Restoration Insurance Claims in Houston

Navigating the restoration insurance claims process can be a daunting task for many Houston homeowners, especially when faced with the stress of water, mold, or fire damage in your home. Confusing policy language, paperwork, and communication with insurance adjusters can make the situation feel overwhelming. However, understanding the insurance claims process and knowing how to advocate for yourself during this time effectively can make a significant difference in the outcome of your claim and the success of your restoration project.

In this post, we will demystify the restoration insurance claims process by providing an overview of the key steps and offering valuable insights on how Houston homeowners can effectively navigate their claims for water, mold, or fire damage. With the right knowledge and support from trusted restoration professionals like Blue Hippo Restoration, you can ensure that your insurance claim is appropriately handled and your home is restored to its pre-damage condition.

1. Understand Your Insurance Policy

Before starting the claims process, it's crucial to review and understand your homeowners' insurance policy thoroughly. Take note of your policy number, coverage limits, and any specific exclusions or endorsements that may apply to your claim. Familiarizing yourself with the language and terms of your policy will better equip you to communicate effectively with your insurance adjuster.

2. Document the Damage

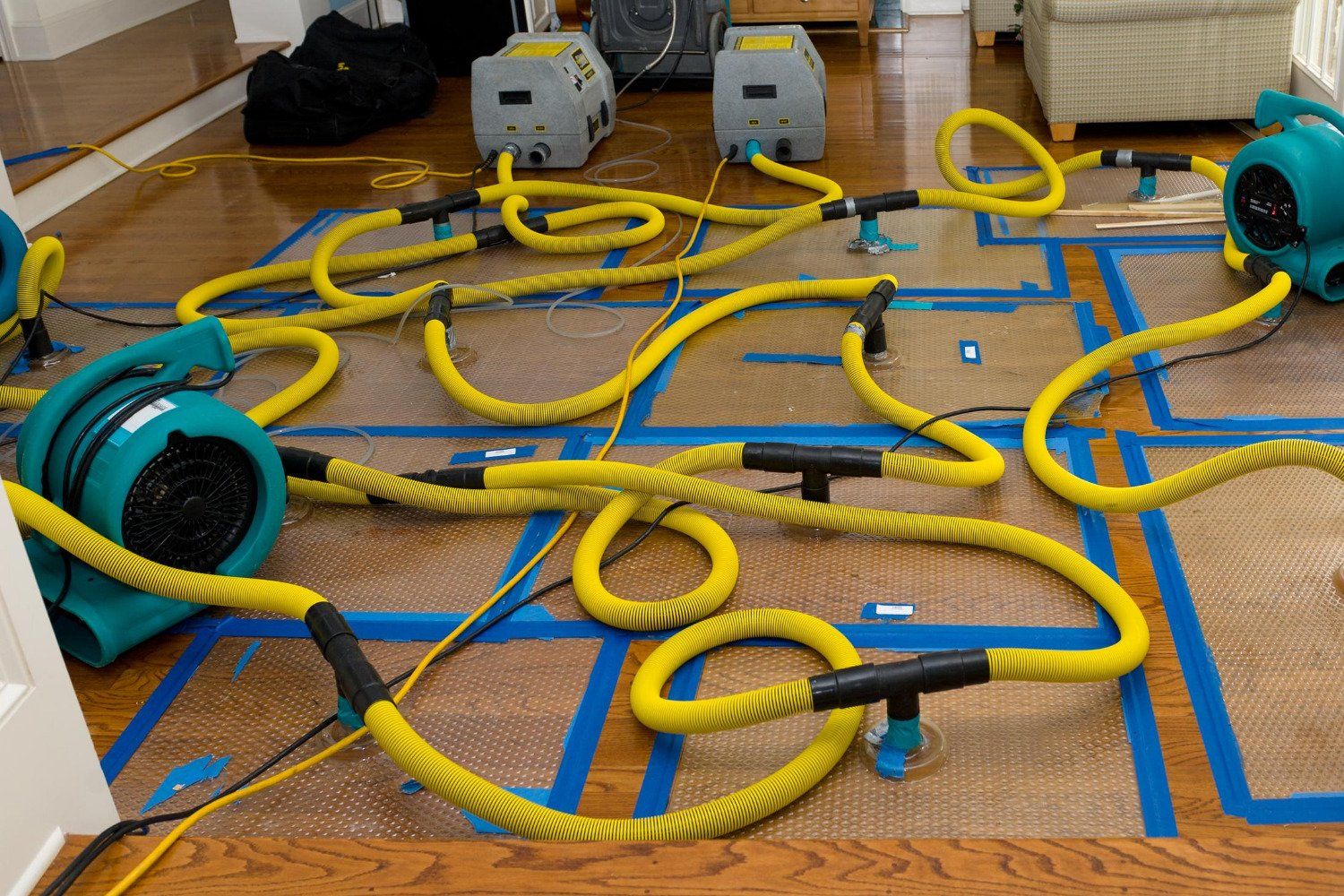

Detailed documentation is a crucial aspect of the restoration insurance claims process. Immediately after the incident, photograph all affected areas and create a comprehensive inventory of damaged items in your home, including their estimated value. This information will help you establish the extent of your loss when submitting your claim.

Additionally, keep a record of any expenses related to temporary repairs or accommodations, such as hotel stays or the purchase of tarps to cover a damaged roof. Many insurance policies provide coverage for these costs, so maintaining proper documentation can help ensure reimbursement.

3. Promptly Notify Your Insurance Company

After documenting the damage, it's essential to contact your insurance company as soon as possible to report the incident and initiate the claims process. Delayed reporting may result in denied or reduced coverage, so acting quickly is crucial to maximizing your claim's potential.

When speaking with your insurance company, provide an accurate account of the incident and the extent of the damage, keeping in mind any information you've documented. Your insurer will likely assign an adjuster to your case, who will serve as your primary point of contact throughout the claims process.

4. Work with a Trusted Restoration Company

The success of your insurance claim and the restoration of your home is heavily influenced by the professionals you choose to work with. Partnering with a trusted and experienced restoration company, like Blue Hippo Restoration, ensures that your damage is assessed accurately, necessary repairs and cleanup efforts are completed thoroughly, and appropriate documentation is provided to support your claim.

Additionally, working with a reputable restoration company can help alleviate some of the stress and confusion involved in the insurance claims process. These professionals have experience navigating claims and can provide valuable insights and support throughout the process.

5. Communicate Effectively and Advocate for Yourself

During the claims process, maintaining open and honest communication with both your insurance adjuster and restoration professionals is essential. This includes promptly responding to requests for information, providing necessary documentation, and clearly expressing your concerns and needs. By doing so, you can ensure that your claim is appropriately assessed and coverage is maximized.

Don't hesitate to advocate for yourself if you believe your claim isn't being accurately handled or your coverage is inadequate. Remaining assertive and knowledgeable about your policy and the scope of your damage can help you achieve the best possible outcome for your restoration insurance claim.

6. Be Prepared for the Claims Process

Before any damage occurs, it's important to be prepared for the claims process. This means having a clear understanding of your policy's coverage limits and exclusions, as well as knowing the steps you need to take in the event of damage to your home.

Consider conducting a home inventory, which documents all possessions and their estimated value. This can help you accurately assess the extent of your loss in the event of damage. Additionally, keep copies of important documents, such as your insurance policy, in a safe place where they're easily accessible.

By being prepared, you can reduce the stress and confusion of the claims process and ensure that you're able to navigate the process should damage occur effectively.

7. Understand the Claims Timeline

It's important to understand the timeline of the claims process, as this can help you manage expectations and ensure that you're taking the necessary steps at the appropriate time.

After reporting the damage to your insurance company, an adjuster will be assigned to your case, and you can expect an initial assessment to be conducted within a few days to a week. From there, the claims process can take several weeks to several months, depending on the extent of the damage and the complexity of your claim.

Understanding the timeline can help you stay organized and informed throughout the process and ensure that you're advocating effectively for yourself and your home.

8. Know Your Rights

As a policyholder, you have certain rights during the claims process. These include the right to an accurate and thorough assessment of your damage, the right to receive timely updates on the progress of your claim, and the right to fair and adequate compensation for your losses.

If you feel that your rights are being violated during the claims process, don't hesitate to speak up and advocate for yourself. You may also consider seeking legal advice or contacting your state's insurance commissioner for assistance.

By understanding your rights, you can ensure that you're being treated fairly and that your claim is being handled appropriately.

Overall, navigating the restoration insurance claims process can be a complex and challenging experience. However, by understanding the process, being prepared, and working with experienced professionals, you can ensure that your home is restored to its pre-damage condition and that you receive fair and adequate compensation for your losses.

Conclusion

The restoration insurance claims process can be a complex and challenging ordeal for Houston homeowners. However, by following these guidelines and partnering with experienced professionals, you can successfully navigate the claims process and ensure your home is restored to its pre-damage condition. Knowledge, documentation, and effective communication are crucial components in simplifying the process and reducing the stress associated with restoration insurance claims.

Blue Hippo Restoration offers top-quality

reconstruction services to support and guide Houston homeowners through the restoration insurance claims process. Contact us today for a consultation, and let our experienced team of professionals help you achieve the best possible outcome for your claim and your home.

More To Explore

Need Help With Disaster Restoration?

GET A FREE QUOTE TODAY

We are IICRC certified and hire only the most trustworthy and dedicated team members to ensure that each job is taken seriously and handled with absolute professionalism.